You may be missing out on thousands of pounds of unclaimed pension tax relief

There's always a threat in the Aitumn Budget that higher rate tax relief on pensions could be abolished.

But, for now, pensions tax relief is safe.

So, just what does this mean to you?

When you contribute to a pension, some of the money that would have gone to the government as tax gets added to your pension pot instead. This is called tax relief.

If you’re a basic rate taxpayer the basic rate of tax is 20%. So for every £80 you contribute to your pension, the government will add £20 to your pension pot.

But if you’re a higher rate taxpayer, paying 40% tax on your earnings over £50,270, then you can get an additional £20 to add to your pension pot. This means that a £100 pension payment will only have cost you £60.

Following a recent conversation with one of my clients, though, I realised that lots of people may be failing to claim their higher rate tax relief, simply because they don’t know that this cashback system even exists!

Are you missing out on unclaimed money?

While celebrating the success with a client of her new job and impressive payrise, I suggested she ask some questions of her existing pension provider, and the pension provider at her new job, to explore her options.

During our discussion, I asked whether she was claiming higher rate tax relief on her pension contributions. She wasn’t aware that this was something she needed to do. She didn’t know she could claim, or that it was up to her to claim. Nor that by not claiming she could have been missing out on thousands of pounds.

She was earning £85,000 and paying 10% of this into her work pension. That’s £8,500 a year in pension contributions. With 20% of this automatically claimed by her pension provider as basic rate tax relief, that means it only costs her £6,800 to get £8,500 invested (£1,700 more than she had to pay out of her paycheck).

But this still leaves an additional £1,700 that she was failing to claim each year as a higher rate tax payer.

Research by Prudential in 2015 found that of higher rate taxpayers who contribute to a pension, 23% are unsure whether they reclaim the full tax relief on their pension contributions that they are entitled to.

So, how do you know if this is an issue that affects you or someone you know?

How do I know if I’m affected?

- Are you a higher rate taxpayer? That is currently (tax year 2023-24) anyone earning more than £50,271pa. You can find out more about income tax rates here.

- Are you a member of a ‘relief at source’ pension scheme? Here, your employer takes your pension contribution from your take home pay – this is after income tax has been deducted. Your pension provider then claims basic rate tax relief - 20% - from HMRC. HMRC sends this to your pension provider who adds this to your pension pot. But only 20% tax, not 40% if you're a higher rate tax payer or 45% if your earnings are above £150,000 and you're an additonal rate taxpayer.

As a 40% or 45% taxpayer, it’s then up to you to claim further tax relief (at your highest rate of tax less the basic rate of tax already claimed on your behalf) from HMRC.

‘Relief at source’ pension schemes are most likely if you’re a member of an individual or group personal pension, self-invested personal pension or stakeholder pension scheme.

If you’re unsure if you’re in a ‘relief at source’ pension scheme, it’s best to contact your pension scheme administrator.

How do you claim this extra tax relief?

Either complete an annual self-assessment tax return or call/write to HMRC and request a higher rate taxpayer relief refund. You can reach HMRC on 0300 200 3300.

Do note, the higher rate taxpayer pension relief you’re due won’t be added to your pension pot. You’ll receive the relief in one of three ways:

- Your tax code will be adjusted. (Your tax code is used by your employer or pension provider to work out how much income tax to take from your pay or pension.)

- A tax rebate (refund).

- A reduction in the tax you already owe to HMRC.

How long can you claim back for?

You can claim back up to four years after the end of the tax year your claim relates to.

So, for example, suppose you’ve just discovered you could have been claiming pension tax relief but haven’t done so. We’re currently in the 2023/2024 tax year, which ends 5 April 2024. This means, you could claim as far back as the 2020/2021 tax year which ended 5 April 2021.

For more information on this topic:

- Who must send a tax return

- Tool to check if you need to fill in a Self-Assessment tax return

- Tax on your private pension contributions

- How to fill in a tax return

Related reading

Self-assessment and tax relief on charitable donations

Spring clean your finances

Don’t let your Chimp take charge of your money

Digital banks helping people manage money mindfully

Ditch New Year's Resolutions - develop good habits instead

Draw your ideal future

What the ELLE is Financial Coaching?

Have you committed Financial Infidelity?

5 Habits of successful savers

Sowing the seeds for financial success

Click here to find out about Financial Coaching or training to become a Financial Coach

Don’t Fall For The Black Friday Hype

Are Black Friday Sales Really Such Great Deals?

Research shows that the vast majority of Black Friday sales don't offer significant savings compared to other times of year. Which? found that only 2% of deals in 2022 were cheaper than normal prices. Retailers use psychological tricks to make us feel like we're getting a bargain even if we're not. They'll highlight a higher "original" price to make the sale price feel exciting, taking advantage of anchoring biases.

Is it Bad to Participate in Black Friday Shopping?

It's fine to buy stuff on Black Friday if you genuinely need or want the discounted items and can afford them. But it's important to avoid getting swept up in the hype and fear of missing out. Advertising aims to manipulate consumers into spending more than intended through limited time pressure and a sense of urgency around "deals".

Understanding Why We're Drawn to Black Friday "Bargains"

The idea is that you see the price that it (apparently) used to be and your mind anchors that as the true value. Paying less then becomes really attractive. Combine this with a limited time period, and a few headline grabbing discounts and you have a formula where the mere mention of Black Friday plants the idea of shopping in our minds, almost as if we've already made purchases before hitting the stores.

Many of our spending decisions are driven by our inner chimps, and we buy things for all kinds of reasons other than purely rational ones: to fulfill needs for esteem, status, or as a reward for instance. And of course, grabbing a bargain can be amongst the type of emotional decisions we make. Compulsive shoppers describe a "buzz" from finding bargains, though the feeling is short-lived.

Tips for Resisting Black Friday:

To avoid overspending or purchases you'll later regret, consider these strategies for navigating Black Friday sales wisely:

- Ditch the shop for other pursuits: Switch off those screens and dive into activities you genuinely love, whether it's quality time with friends, an exercise session, or a captivating film.

- Calculate the real cost: Break down the hours of hard work needed to afford an item. Is that flashy TV truly worth weeks of toil?

- Cap your spending: Instead of abstaining from sales, set a sensible budget and shopping list in advance of browsing deals.

- Shift your perspective: Call it 'Red Friday' instead of 'Black Friday,' and all it a 'Debt Card' rather than a 'Credit Card.'

- Pay with cash: Opt for tangible currency when shopping on the High Street. It's more challenging to part with real money than a plastic card.

- Reflect before you splurge: Identify the emotion driving your spending impulse. Whether it's the fear of missing out or a distraction from unhappiness, tackle the root cause.

- Connect with your goals: Create an affirming statement to remind yourself what truly matters. Slip it into your purse or wallet for a constant reminder.

By recognising psychological tricks at play and focusing on what really matters, you can resist the lure of Black Friday "bargains" and avoid spending you may later regret. True savings are possible by shopping smart, not getting swept up in advertising hype.

Image by gonghuimin468 from Pixabay

Related reading

What are we giving our children at Christmas?

What’s your attitude to money teaching your kids?

Don’t let your Chimp take charge of your money

Digital banks helping people manage money mindfully

Ditch New Year's Resolutions - develop good habits instead

Draw your ideal future

5 Habits of successful savers

Sowing the seeds for financial success

Click here to find out about Financial Coaching or training to become a Financial Coach

What are we giving our children at Christmas?

I was chatting to my hairdresser the other day, having the conversation we’re all having at this time of year: “You all set for Christmas? Done your shopping yet?” She said she was all ready, excited for her young children aged 7 and 10, and revealed that her budget was £600 per child.

I left the hairdresser contemplating this, and the wider implications of that kind of spend. It set me thinking about what we’re actually giving our children at Christmas. Every parcel under the Christmas tree is wrapped not just in sparkly paper and ribbons, but in many layers of belief and attitudes and values. While the actual presents may soon be forgotten, these extra layers often stay with people for their whole lives – affecting how they deal with money, love and giving in adulthood.

It’s these beliefs and attitudes – and the emotions they evoke – that are central to my work. Often I'm helping clients to look back at those layers and see them clearly and explore how they may be blocking them from achieving their goals. One of the first questions I ask is what people have absorbed about the subject of money - consciously or unconsciously - throughout their life. And gift giving is one of the clearest ways to see this.

There are different ways of expressing and experiencing love; for instance spending quality time with someone, offering words of affirmation and providing acts of service. Giving gifts is just one way. I don’t think it’s healthy when love and money get tangled up and mistaken for each other. If we spend £600 on saying ‘I love you’ to a young child, what are we setting them up to expect for the future? What will we spend next year? And the next? What if that child grows up and forms a relationship with someone who doesn't give big gifts - will they then feel unloved? And I worry about the implications within the household - research shows that 90% of the UK population aren't putting enough money away for the future - when so much is spent on gifts.

There’s so much manic consumerism that goes on in the lead up to Christmas, and panic that we haven’t bought enough or that our gift or gifts won’t be ‘enough’. Black Friday showed us that we’re so caught up in this frenzy that we’re prepared to fight over consumer goods in public. What is that teaching our children and young people?

I coach clients in other ways of giving - like having a cap on spending, or a secret Santa system so you only have to buy for one person. The solution often involves simply making agreements in advance and managing expectations, and finding meaningful ways to express love and affection without breaking the bank.

So, my question to you is what do you want your children to understand about money and love? Let’s start spending and giving more consciously. Fast forward a few years from now and see these young people as adults looking back on the values and beliefs they received and how that has affected their lives. What beliefs and attitudes would you love to give them? Now, that’s a perfect gift.

Related reading

What’s your attitude to money teaching your kids?

Don’t let your Chimp take charge of your money

Digital banks helping people manage money mindfully

Ditch New Year's Resolutions - develop good habits instead

Draw your ideal future

5 Habits of successful savers

Sowing the seeds for financial success

Click here to find out about Financial Coaching or training to become a Financial Coach

Spring clean your finances

With the weather warming up and days getting longer, now's a perfect time to get yourself motivated to make changes. So, here’s a simple springtime challenge for you...

Pick one of these 10 suggestions and decide to take action on it. If it helps find a friend or partner, pick a task you both need to do and do it together. Sit down one evening, open a bottle of Malbec and browse price comparison websites together. Or take turns to help sort each other’s paper mountains over a packet of chocolate biscuits.

Do whatever you need to do to make the tasks more palatable and then decide on one action - one small sweet step at a time. Never underestimate the power of doing what you say you’ll do…I guarantee it will put a spring in your step.

So, are you ready...?

1) Get your paperwork in order

You can’t beat the feelgood factor of having your paperwork in order. Piles of paper can make overwhelming mountains out of administrative molehills. Sorting it out is often just a question of getting a good system in place – it’s the dithering and agonising over where to put something that often makes us put off the whole task. So think what small steps could help make filing a doddle of a daily habit. One idea is to create clearly labelled, separate files in transparent wallets for each account and keep them somewhere safe and accessible. This also applies to documents stored on your computer or in the cloud, where you can create folders and subfolder, so everything is easy to find. All this is especially important if you have your own business. This is the time to organise receipts and gather your paperwork for the end of the tax year. If you get your return done now you’ll have plenty of time to plan for the next big tax bill (in January 2023) and you may save on accounting fees – some accountants charge less if you get your returns in early.

2) Start saving

If you’re not already a regular saver it’s time to get the saving habit. Set up a system, whether it’s £50 a month transferred to a savings account, or even a tenner in a tin! The important thing is to save by default rather than waiting until you feel you have enough to save, as that feeling may never happen. There are also some great apps which help you build a savings habit. Some allow weekly payments, pay day bonuses or 'save the change' options (rounding up each spend to the nearest pound), which encourage you to save without much effort or feeling the pinch.

3) Check your interest

It’s in your interest to keep up to speed with interest rates on savings accounts or Cash ISAs. If you’ve got old savings accounts that pay low rates it’s worth transferring your money to an account that gives you more. Many accounts lure you in with introductory rates that disappear afte a while, so don’t fall into the trap of sitting tight on old accounts. If you have enough saved as a back-up reserve and to meet any short-term goals, now's the time to start thinking about trying to get better returns by investing in the stock market. While Cash ISAs earn you interest, inflation nibbles away at your money in terms of purchasing power. Whereas Stocks & Shares ISAs, for instance, have the potential to generate far greater returns through dividends and capital growth. Check out websites like Boring Money, Money to the Masses or Meaningful Money for ideas on how to invest your cash to generate higher returns.

4) Deal with debts

If you have any debts, now’s a great time to sit down and work out a payment plan to clear them. Make a list of everyone you owe money to, how much you owe, the minimum payments you’re currently making to each and the rate of interest you’re being charged. Most people who take out a loan to repay their debt end up accumulating further debt within the year. So I'm much keener on the principle of snowballing it. Here's my snowballing video, which takes you through this snowballing method, using a great tool to help you work out a plan to become debt-free. Seek free debt advice services, such as StepChange, if you're unable to afford your debt repayments.

5) Review your mortgage

It’s time to review your options – maybe arranging an appointment with a mortgage broker to assess whether your current mortgage arrangements are still right for you. For example if you’re on a standard variable rate deal, would now be a good time to switch to a fixed or tracker rate mortgage? Or if your mortgage is interest only, could you now switch to repayment? If you’re struggling to afford to meet the extra repayments, find out if your mortgage lender will allow you to overpay the loan without penalty, so that way you could at least build up funds towards the cost of the mortgage itself and not just the interest. This can be a good half way house if you don’t feel able to make the monthly commitment of a repayment mortgage. The important thing is to do something towards eventually repaying your mortgage, even if that is building up savings or arranging an investment that could build to a lump sum to repay the loan.

6) Review your net worth

Your net worth is like a financial report card, enabling you to take stock of the complete picture of your finances rather than just seeing one aspect. It gives you a figure that is the total value of your property, pensions, savings and investments, minus any mortgages, loans, credit cards or other debt – and you can calculate it using my ‘Net Worth’ worksheet. This figure gives a valuable perspective to check in with yourself, comparing where you stand from one year to the next; and to make, and keep track of, your financial goals.

7) Review your energy and phone supplies

They’re banking on the fact that few of us do this. We’re often put off by thinking it’s going to be a daunting, time-consuming and complex task. But there are plenty of websites and online tools that make comparisons easy. Sometimes it’s just about negotiating the best tariffs with your current suppliers. Or haggling with them over the price, quoting prices offered by competitive suppliers. Compare deals for utility bills by visiting www.uswitch.com or Martin Lewis' Cheap Energy Club. And consider ways to mitigate the hike in energy prices by discovering 102 energy-saving tips for your home.

Compare the latest mobile phone bills via moneysupermarket.com/mobile-phones and ensure you understand your phone tariff so you’ll be less likely to go over your allowance. Or take a look at Martin Lewis’ website to review cost cutting ideas.

8) Check your credit rating

It’s good to do this once a year so that you know for sure that everything is ok on your record. Don’t wait until you have to borrow money as you may then not have time to address any mistakes or problems. It is possible to check this without being charged through a 30 day free trial with an online credit reference agency such as Experian, Equifax or TransUnion. Or, for a thorough view of your credit report and score simultaneously from four of the main credit reference agencies (Experian, Equifax, TransUnion & Crediva), try CheckMyFile's free trial. But be sure to read the small print and beware of the trap - it’s easy to sign up for the free trial and then forget to cancel it within the 30 days (and they don’t make it easy, it’s not a direct debit and you have to phone or email to cancel it).

If you think you’re unlikely to cancel, it could make more sense just to refer to Which?'s article on this and apply for one of the free credit scores.

9) Track your spending

You can use a notebook and pen, a spreadsheet for the tech-savvy, a simple app like Money Dashboard or an app linked to your bank. However you want to do this is fine. The important thing is to understand where your money is going. Only then are you able to start taking control of it. You don't have to work to a budget, but you might want to create some spending rules or principles which make it easier for you to achieve other goals like paying down debt or building up your savings,

10) Find time for your finances

Last but most definitely not least, schedule some time each week or each month to devote to your financial housekeeping. Just like the physical housework, it’s the compound effect of small, regular efforts that can make a massive difference. With money, achieving your goals is normally not about how much you earn but how you control your cash and this regular attention could mean the difference between a comfortable retirement or trying to live on a State pension. So give it a regular slot in your diary, to check your bank balances, review, diarise, prioritise, and decide when you’ll do the rest of these spring cleaning tips…!

Related reading

Don’t let your Chimp take charge of your money

Digital banks helping people manage money mindfully

Ditch New Year's Resolutions - develop good habits instead

Draw your ideal future

What the ELLE is Financial Coaching?

Have you committed Financial Infidelity?

5 Habits of successful savers

Sowing the seeds for financial success

Click here to find out about Financial Coaching or training to become a Financial Coach

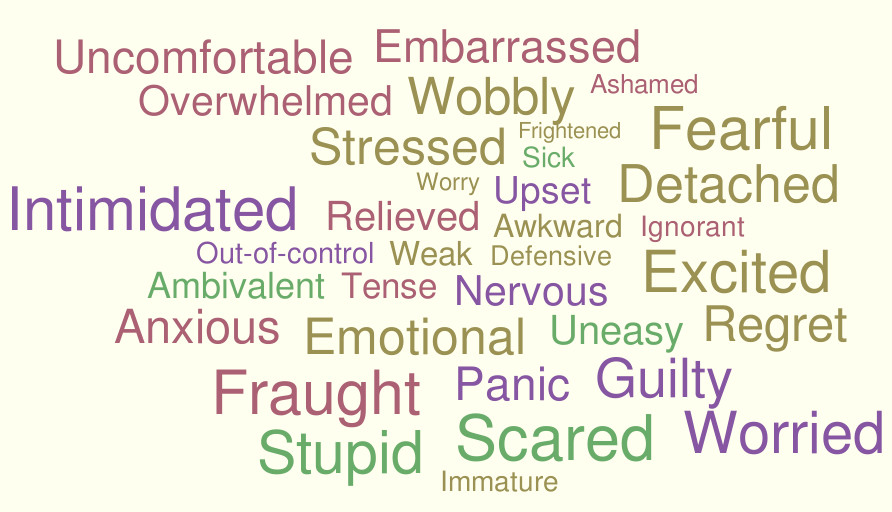

Don’t let your Chimp take charge of your money

Right now in the UK there’s a frenzy of drivers queuing for fuel. Whilst there’s no actual shortage of fuel – just a shortage of HGV drivers to transport it to petrol stations – people are responding emotionally to the Government telling us “don’t panic buy” and the contrasting media coverage of queues at forecourts. This has inflamed the situation and we’re seeing similar results to the lockdown stockpiling of March 2020.

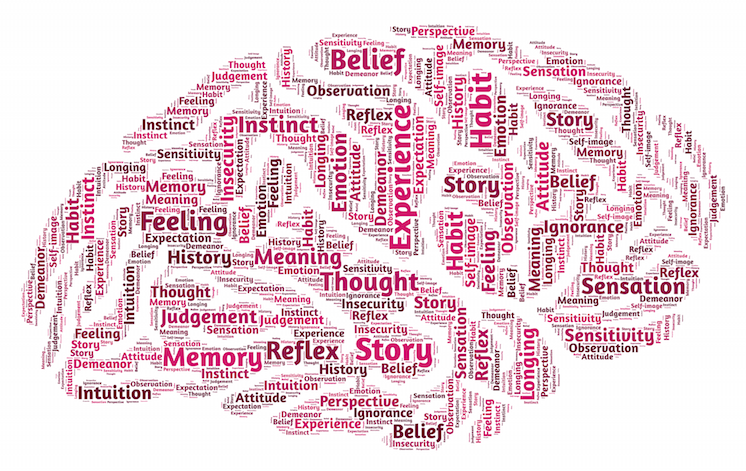

The emotional reaction of many people to this situation makes me think of “The Chimp Paradox”, a concept created by Professor Steve Peters in his bestselling book of the same name. The concept aims to simplify complex neuroscience (the activity of different parts of the brain) into a framework that’s easy to grasp. I frequently use The Chimp Paradox when I coach people on their decisions around spending, saving and investing.

To explain the concept of The Chimp Paradox, firstly, think of your brain divided into three separate components:

- Human

- Chimp

- Computer

These three components actually correspond to three different areas of the brain:

- Frontal lobe = Human

- Limbic system = Chimp

- Parietal lobe = Computer

It’s much more useful just to think Human – Chimp – Computer instead of understanding brain anatomy and function!

-

Your Human is logical and rational: it knows what to do for the best when decision-making and it knows how we want to be functioning.

-

Your Chimp is the mischievous and emotional part of us: it’s an independent, emotional thinking machine but can hijack commonsense. It often makes decisions that don’t serve you – it’s not good or bad, it’s just your Chimp!

-

Your Computer runs the programs in your mind and stores everything: it’s like your body’s autopilot, for example, taking control of your breathing or riding a bike. It’s continually programmed with experience after experience, creating new pathways. It’s the reference point for both Human and Chimp.

The next step is understanding the relative power of these three components in your brain:

- The Chimp is five times stronger than the Human

- The Computer is 20 times stronger than the Human

Your Chimp is far more powerful than your Human, which explains why making changes or the ‘right’ decisions can be fraught with failure. Using willpower alone is like arm wrestling a Chimp that’s five times stronger than you. It also means we have to be very careful about what programs we’re running in our super-powerful Computers!

Let’s just say you (or your Human) decides to take control of your spending and says to itself “I’m going to pay more of my debt this month and not buy things i don't need.” But then you discover your favourite online shop has a sale on. Your Chimp starts twitching with excitement, convincing you that the sale has items you need. Whilst your Human tries to resist the temptation, your Chimp steers you to the online shop, just for a look. “Go on - buy it!” squeals your Chimp, whilst drawing upon Computer memories such as: “You always feel more confident with new clothes"; " You deserve a treat after the week you've had!”. Your Chimp craves immediate gratification, but isn’t necessarily aligned with your values or long term goals.

So what can your Human do? There's no escaping your Chimp: everyone has one and they’re extremely strong-willed. The key to success, suggests Professor Peters, is learning strategies to manage your Chimp:

1. Exercise your Chimp, then box it in:

- Exercising your Chimp means expressing your emotions, but in a managed way. If something feels unfair, for example, your partner is making financial decisions that make you feel unsafe, the worst thing to do is to communicate from that place of emotion.

- Exercise your Chimp first: go for a run; talk to a trusted friend; rant as much as you want in a private journal. Afterwards, box-in your Chimp so your Human can take control of communication.

- Failing to exercise your Chimp will just keep it raging and, if you let your Chimp take control of communication, it can wreak havoc!

2. Distract your Chimp, or feed it a banana:

- You can apply immediate solutions to help control your Chimp’s impulsive behaviour.

- One of my clients who struggles to control her online shopping keeps a “I really need it” list beside her computer. If she’s browsing online and her Chimp starts to take control, she refers to her list. Her Chimp gets to satisfy its urge and she buys something she actually needs.

- Another useful online shopping strategy is to delay your purchases until the next day by leaving the items in your online basket overnight. This can often result in the retailer offering you a discount to complete the purchase, or you may not even feel the need to checkout.

3. Learn to nurture your Chimp:

- Understanding the triggers for unhelpful behaviours lets us discover what emotional need your trying to meet? Then you can find other ways to nurture your Chimp!

- Instead of making an impulsive purchase as a way of regulating your emotion, find alternative strategies.

- Another client of mine recognises her overspending triggers include: anger, distress and the sinking feeling of becoming overwhelmed. Shopping allows her to come up for air and gives her space to escape from herself and others. Talking this through, we rehearsed some new strategies she now adopts when her Chimp is poised to take over:

- 7:11 breathing

- lighting scented candles and sink into a tub or reading a book

- getting curious about the feeling instead of tryng to numb it

- reaching out to a close friend to vent

- focusing on the picture on her wall representing her desired new reality

Likewise, we need to take control of how we’re programming our Computers and what references our behaviour and decisions are based upon. Some people I talk to who run their own businesses keep wondering why they’re always charging too little; why they never seem able to have any money despite significantly increasing income; why they repeat patterns of poor behaviour over and over again. In this situation, it’s a case of reprogramming your Computer.

Professor Peters talks about ‘Goblins and Gremlins’, embedded deep in our Computer programs, which I refer to as ‘self-limiting beliefs’. For instance, one client told me that "Money was scarce as I was growing up. Now I've got it, I want to be able to spend it". These can be like glass walls which we often don’t know exist until we bump into them – even then, we can choose to ignore them. The programs are so ingrained that they can feel an immutable part of self “That’s just how I am!”. We often don’t see it as a belief so any attempt to change will be doomed. The question you need to ask yourself is: “What programs am I already running?”. If they’re unhelpful to your current life plans, what can you do to change them? We all need to reveal what’s become embedded in our Computers, make an assessment, then make changes if the programs are unhelpful.

In the same way that we shouldn’t allow our Chimps to take control of our current decisions around buying fuel, we also shouldn’t allow them to control our decisions around spending, saving and investing. If we can train our Chimps and reprogram our Computers, our Human can lead a fulfilling life where our personal finances are completely aligned to our life values and plans.

Like other types of coaching, the Financial Coaching I provide at Wise Monkey is ultimately about understanding yourself better. We can all change: I know this absolutely and categorically from my own lived experience and from hundreds of clients that I’ve worked with over the years. Awareness is the key to getting our Humans, Chimps and Computers working harmoniously.

So, my advice is train your Chimp, feed it a banana every now and then, and rehearse a new strategy the next time it decides to panic buy!

Related reading

Digital banks helping people manage money mindfully

Ditch New Year's Resolutions - develop good habits instead

Draw your ideal future

Have you committed Financial Infidelity?

5 Habits of successful savers

Sowing the seeds for financial success

Click here to find out about Financial Coaching or training to become a Financial Coach

What drives our emotional relationship with money?

In my role as Financial Coach, I have the pleasure of meeting some incredible people - clients and colleagues alike. Jane Thurnell-Read is one of them. In her 70s, she embarked on a big new project – an international membership website for healthy ageing – www.upliness.net. The idea was to offer a more positive view of ageing, inspiring people to become happier, healthier and fitter as they age.

I really enjoyed my conversation with Jane as a guest on her membership site. In this video, I explained what Financial Coaching is, what drives our emotional relationship with money and how we can shift our money mindset. I also shared more about the community we're creating and the Financial Coach Practitioner Certificate training we offer.

Click here to find out about Financial Coaching or training to become a Financial Coach

Turning passion into profit

So many of us have things we’re passionate about, but assume we have to fit in around the edges of sensible, earning lives. But over the last year or more – with Covid and Lockdown – everybody’s routines have been disrupted. And some of that disruption has proved really fruitful.

We’ve been forced to stop, and look at what we’re doing.

One Lockdown success story is Hanri van Wyk’s. Hanri, a long-term client of mine, has over recent years revolutionised how she works and lives. And Lockdown has brought further consolidation.

Today, Hanri believes she has found her niche, and she’s thrilled about it. It’s such an inspiring story I thought I’d share.

Think outside the box

Hanri, over the last years, made the gradual shift from full-time employment (as a designer in children’s publishing) to a resilient, resourceful, portfolio life: juggling art directing contracts, freelance photography, yoga teaching and selling sewing patterns.

‘Simonne got me to think outside the box right from the start’, Hanri says. ‘So, for instance, we rented our house out for a while on Airbnb. Or, when I wasn’t charging enough as a freelance photographer, Simonne helped me see this was unsustainable and uncover what was getting in the way of charging more.’

Hanri, now approaching forty, is a massively creative person, visibly buzzing with ideas and initiatives. ‘I have lots of interests’, she laughs, ‘loads and loads of hobbies. One thing I needed to learn was to focus a bit.’

And perhaps ironically, it is finally Lockdown that has brought that focus.

Of course, the last year has tested us all: for Hanri, it’s proved a positive challenge. Some of her regular work dried up completely: the yoga teaching, photography; an art directing contract disappeared. But… that’s not the whole story.

Yogahound, Hanri’s sewing pattern store on Etsy, has turned into a real lockdown success.

Focus on one thing

Yogahound combines all Hanri’s skills, experience and interests: publishing, photography, yoga and sewing. ‘That’s what’s brilliant about it, for me,’ she says. ‘I wouldn’t have thought it possible for me to make a living selling my sewing patterns. But that’s what I’m currently doing!’

Hanri maintains the site, and publishes a new pattern once a fortnight (for which, ‘I have too many ideas’). The shop has gone from strength to strength. Sales are burgeoning. (‘I guess I’m not the only person sewing more!’) And Hanri’s really enjoying the simpler life.

‘It’s nice to focus on just one thing. I don’t think I realised how much I did before. I used to rush rush rush. Now, I’m even sewing more tidily. And – one thing I thought I’d never say – I have learnt to love routine.’

Yogahound, the brand, is ‘all about mindful sewing, and clothes you can move in’, says Hanri. ‘I also love dogs – had a greyhound – hence the hound.’

Hanri says I also have something of ‘a minimalist approach’ – which has rubbed off. ‘My lifestyle has become much more sustainable’, she says. ‘I definitely now put quality over quantity. And in Lockdown, I’ve slowed down massively.’

Grow resilience

But she’s also not scared of future challenges. ‘Simonne taught me the power of changing my spending habits’, she says.

‘She really helped me see it was up to me. It was amazing – the changes she helped me implement from the start. It’s made all the difference. I’m not scared any more: I don’t spend money I don’t have. I don’t avoid looking! I’m never scared of a tax bill. I’ve learnt it’s not about what I earn, it’s about what I spend. And understanding that has changed everything.’

‘Resilience’ is the single most valuable thing she’s got from her work with me, she says.

Meanwhile, just a cursory glance at Yogahound reveals a lively hub of enthused customers, and a site stacked with five star reviews. Hanri’s clearly got this sussed: do what you love, and focus on doing it excellently.

So, what passion can you turn into profit?

Related reading

Digital banks helping people manage money mindfully

Ditch New Year's Resolutions - develop good habits instead

Draw your ideal future

Have you committed Financial Infidelity?

5 Habits of successful savers

Sowing the seeds for financial success

Click here to find out about Financial Coaching or training to become a Financial Coach

A smooth transition to online training

‘The course is incredibly well-designed’, says Martha Lawton, who trained online with us in October 2020. ‘I’m a trainer myself, so can be hypercritical – but this course is intense, slick and fun.’

Since the pandemic, we’ve moved our Financial Coach trainings online, and we’ve discovered real benefits to doing so. The traditionally five-day course now lasts ten consecutive work mornings. There are currently a maximum of six trainees, to our three facilitators.

‘It’s really intensive’, says Martha, ‘in a good way. And the group was great – really mixed.’

Full on, fun and engaging

‘It’s a full-on course,’ agrees Funmi Olufunwa, who trained in July’s cohort. ‘Having mornings only is really good; you need the afternoons to process.

‘I was apprehensive about Zoom overload, but actually it works really well.’

Funmi, who’s a lawyer, says: ‘You don’t lose the intimacy, online; and the course is packed with content… Definitely thought-provoking, and insightful.’

And Jeremy White, who also trained in July 2020, agrees. ‘I absolutely loved the online version’, he says. ‘I’m an introvert anyway, and I found it far easier to concentrate and focus this way, without distractions.

‘I found the whole experience engaging, fun and informative.’

Playing the detective

One vital element of the trainings is the ‘Case Study Practice’ – quite involved role-playing.

‘One of the facilitators is a trained actor, and she portrayed a client first’, says Martha. ‘Later we broke into groups, and played each part ourselves…

You get a lot of individual attention, a lot of personal feedback that’s really useful – in depth, and detailed. ‘It’s all about developing coaching skills. On the one end of the spectrum, there’s teaching, instructing, advising – on the other, pure coaching. In Financial Coaching, we learn to sit in the middle.’

Jeremy has worked in financial services for 32 years. 'The case study practice was brilliant,’ he says. ‘You have an audience of two – one observer, and a trainer – and you forget they’re there, and get totally absorbed in working with your ‘client’.’ He said he had some ‘trepidation’ beforehand, ‘but it’s so good to do the roleplays, and actually fun, with the right attitude.

‘The feedback’s helpful. Having been a financial planner for seventeen or eighteen years, I’m so used to taking on other people’s problems and solving them. Coaching is about not doing that!’

Funmi also rated the case study practice. ‘I really liked the detective element’, she says. ‘You’re given a set of facts about a ‘client’: on the face of it, x means y; but you know there’s hidden material.

‘I really liked that. It encourages you to stay with it, and think a lot broader. Keep an open mind. Not impose your own assumptions, but come to everything like a blank sheet of paper – which is how we need to work with real-life clients, too.’

Rooted in practice

George Callaghan is one of our trainers – he did the training himself, and so met Simonne, three and a half years ago. In another life, he also works as an Open University personal finance academic – work he describes as ‘groundbreaking’ – and he thinks financial coaching is fantastically relevant.

‘It’s quite new in the UK, but it’s gaining traction. It’s about devolving decisions down to the individual – which is crucial. Society demands people make financial decisions all their lives. But we’re never taught how.’

George agrees moving the training online has brought some real benefits. ‘One big plus is location matters not at all,’ he says, ‘so it opens up the training to all who are interested.’ Also, there’s now a wonderfully supportive online network of peers and previous trainees you can join as soon as you come off the course – so the benefits and support are ongoing.

George also thinks the ‘very involved role playing is a tremendous asset’.

‘Simonne’s developed an intense and transformational programme,’ he says. ‘A physical folder full of stuff; very well supported, well resourced, and – crucially – above all else – rooted in practice.’

We’re continuing to develop our online training into 2022 to maximise everyone's learning experience and improve our trademark high quality.

Click here to find out more about our training.

Growing a Community of Financial Coaches

We were hugely excited about bringing everybody who’s trained with Wise Monkey together for the first time this year – in spring 2020.

Our trainings have always been held in small groups, and we’d never before organised a big event. But we had one all planned and scheduled for April 2020.

Of course, by then, the pandemic had struck and it was not to be. As a substitute, we convened a meet-up online.

Still, we had no idea what was about to happen: a one-off check in has turned into a regular weekly fixture. The sense of community that has emerged has surpassed any expectations: it feels like we’ve become a movement.

Collaborating not competing

It’s been beautiful – watching people build connections. Everyone involved is so different, and it’s precisely that diversity, and pooling of experience, that’s been so rich. So many groups and sub-groups forming. So many buddyings-up.

And the overriding characteristic? Generosity. Across the board. People collaborating, not competing. This is the message that keeps emerging.

People are tendering for work together. Encouraging and supporting each other. It’s a practical network of trained financial coaches with a shared purpose and ethos – to transform clients’ lives. A living system of peer support, and on-tap supervision.

And a real bonus to our Wise Monkey training.

Welcoming community

It’s wonderful to have a welcoming community to point new trainees to when they come off our intensive course: there’ve been 24 new arrivals since we started the weekly sessions.

Sasha Speed is one. Sasha completed her Wise Monkey training in summer 2020, and she’s currently working towards practising. She says she ‘uses this group to remind myself I am a financial coach’.

One initiative that’s emerged from the Wednesday mornings is a (finance) book group – set up by two members. Sasha’s joined this; and more broadly laps up learning. She says she makes ‘copious notes’ each week.

‘There’s so much information shared, it’s a fount of further knowledge. Such a broad range of personalities and styles, and each person being their authentic self.

‘The community is made in Simonne’s image’, says Sasha: ‘generous, supportive and energising.’

Everyone learning

And it’s not only recent trainees who report reaping benefits. Graham Wells of GroWiser Financial Coaching, who trained five and a half years ago, says the Wednesday mornings are proving really special.

‘They spark me back into action’, he says. ‘Members are from such a vast range of backgrounds, across finance, and coaching.

‘There’s something for everyone to learn from everyone.’

Graham ran one Wednesday morning session himself – on coaching competencies. ‘It’s a brilliant community for sharing best practice’, he says; ‘empowering, reflective and full of integrity.’

Finally, Sara Maxwell, of Wealth Coach, trained in January 2020 – ‘although it seems much longer ago! I trained in a group of six, and we’ve kept closely in touch too, as we’ve each been building our own practice.

‘That peer support has been incredible,’ says Sara; and the small group has even formed its own podcast: Money Natters.

‘Simonne herself is so open and encouraging; she gets really excited for you. And the big group is the same: it’s a vision to see other people doing this work really successfully. And all of us sharing tools and books and resources…’

Winning ingredient

Sara also thinks the variety in the group may be its winning ingredient.

‘Everybody’s a strong individual; nobody is copying anyone. Nobody thinks they’re better than anyone else. And everybody is giving. We’re all engaged in the same common purpose – the life-changing work of helping clients regain control and self-reliance.’

So how does Sara describe the Wise Monkey community? ‘Empowering, encouraging and I want to say FUN!’ She describes a session she co-ran recently, and adds ‘I really enjoyed myself.’

And to think, none of this would have happened without the pandemic. Our work with clients is always nourishing. Now we have a community too, built around that, and flourishing.

2021 will certainly see this develop further. At the time of writing, we’re just surveying all our members, to ask what do people want, going forward…

Watch this space for further, exciting developments.

Click here to find out more about our online training.

Financial support during COVID19

Our relationship with money is challenging at the best of times. But right now, with reduced salaries, business losses, savings being depleted and stock markets falling sharply, it's testing the financial health and anxiety levels in all of us. While there's a lot of support and help out there, it's not always easy to navigate when we're emotionally charged.

Dr George Callaghan and Simonne Gnessen were asked to put together a webinar to help people through this difficult period, in particular to recognise that they have substantial personal resources and energy they can draw on during this challenging time. It's aimed at employers, employees and self employed business owners.

Let us know if you have any questions.

Related reading

Digital banks helping people manage money mindfully

Do the names Monzo, Starling, Chase and Revolut mean anything to you?

I often discuss with my clients how these type of digital banks help make money management more accessible and fun than a traditional bank by using your smartphone to track your spending.

These digital banks offer easy-to-use budgeting tools, instant notifications when you spend and straightforward ways to save. And this is all available at your fingertips, via your mobile phone.

They’re also helping to create conscious, mindful spending.

Mindful spending

Credit cards could more accurately be referred to as debt cards, as they make it easy to rack up debt and forget how much you’re spending when your bill doesn’t come in for weeks.

With some of these digital banks, your mobile phone pings at you, in real-time, to notify you of each bit of spending as it occurs. The clarity and transparency of this makes for conscious, mindful spending and that’s why the idea of using one of these banks comes up so often in coaching sessions.

Some people choose to move their banking over to a digital bank entirely. Others use their existing bank for direct debt, standing orders and other bills, then set up a secondary account with one of the digital banks for discretionary spending - things that come up most months, like food, clothes, eating out and entertainment - but vary in amount. That way, they can pay themselves a set amount each month for these types of spends and easily monitor how well they're sticking to the plan.

Sticking to a plan

Whenever you make a purchase with one of these digital banks, they automatically track it in one their 13 or so categories of spending, such as groceries, eating out or travel. That way you can set budgets for different categories and easily and effortlessly track spending against each type of spend. It makes sticking to a plan easy and, dare I say it even fun! You can set up pots, name the pots and even attach a photo.

I find clients who have never managed to control their spending using these types of accounts and pretty quickly starting to feel in control.

Envelope system

An old fashioned style of managing money that people still successfully use, is to stash away a set amount of cash each month and split it into different envelopes for things like food, clothes, entertainment etc. That way, you can only spend the money that's left in the envelope for the month. Simple to use, but relies on us having pots of cash at home. The new digital banks allow you to do something similar via their app, by stashing away money in pots. If you then withdraw from the pot before making a purchase, it means you can easily track the spending from that pot and stick to the limits you set. You can even set up a regular pre-load of each pot with a certain amount of money at the start of each month, so you don't have to remember to do this manually.

Managing discretionary spending

If you prefer not to budget in this detailed way, you could simply pay yourself a weekly or monthly amount into your digital bank account to cover all of your discretionary spending and you'll see each time you glance at the app how much is left to spend for the month. You can also monitor spending against set goals for each spending category.

Start by looking back at your finances to see the different areas of discretionary spending you have. You can then put a plan together of what you’d like to spend in each area from now on.

Managing occasional spending

Your partner’s birthday that comes with a present to buy and a celebratory night out; the holiday booked for the summer; your car insurance policy, MOT and service; Christmas… these are all things we know about in advance but often fail to account for until the moment is upon us.

Digital banks allow you to spread the cost of occasional spends by creating pots of cash to stash away money each month. That way you’ve got money saved to cover these types of spends when they arise and avoid the need to use credit cards. Some digital banks even allow you to lock your pot to stop yourself dipping into it.

If Christmas is likely to cost you £500, then planning ahead to save around £40 a month from the start of the year is better than trying to find £500 in December.

‘Sweep’ your spare change into savings

The ‘sweep’ feature acts like a digital piggybank or coin jar.

It allows customers to round up transactions and ‘sweep’ the spare change into a savings pot. For example, you can set it so that if you’ve spent 80p, the app will round up the transaction to the nearest pound and sweep 20p into one of your savings pots.

For people who have never saved money, this can be a good way of starting to save small amounts and see those savings grow over time.

As a financial coach, I work with people who want to change their financial results. This usually involves helping them change their behaviour with money and form new, positive habits that requires small and consistent action. Small, because it’s more achievable; consistent, because this helps habits stick.

The ‘sweep’ feature helps customers take small and consistent action.

Here's a sample of messages I've had from clients who started using digital banks:

“I’m within my set budget for the month with a few days to go and it feels great.”

"I’ve been getting on really well with Monzo and budgeting these last couple of months - its amazing how less money I’m spending, just because I’m seeing my money each day and I’m categorising it. I never knew budgeting could be so simple!"

Check out the following articles to find out more about these types of accounts:

- https://www.which.co.uk/money/banking/bank-accounts/challenger-and-mobile-banks-aj0mj7w688r5

- https://www.moneysavingexpert.com/banking/digital-banking

- https://moneytothemasses.com/quick-savings/tips/the-best-budgeting-apps-in-the-uk-how-to-budget-without-trying

Not all digital-based banks are fully licensed banks. Ones like Starling Bank, Monzo and Chase are all protected by the Financial Services Compensation Scheme (FSCS) meaning that your money (up to £85,000) is protected should the bank go bust. Others like Revolut hasn't yet become a bank so doesn't currently have that protection.

Related reading

Don't let your Chimp take charge of your money

Ditch New Year's Resolutions - develop good habits instead

Draw your ideal future

Have you committed Financial Infidelity?

5 Habits of successful savers

Sowing the seeds for financial success

Click here to find out about Financial Coaching or training to become a Financial Coach

Seven ways to make 2020 the year you get your finances in order

There’s no better feeling than being in control of your money. However much or little of it you have, these 7 tips will help you get organised and plan for the year ahead. Don’t worry if it takes a couple of months to put it all into practice – try setting a goal of mastering a new money habit each week. By the time 2021 rolls around, you could have your money management totally nailed.

1. Create streamlined systems for your financial paperwork and digital documents

Think bills, wills, insurance documents, tax returns and receipts. You’ll need one system for paperwork and another for digital documents. A system that lets you find things easily - so that when you need to put your hands on something, the thought of finding it doesn’t become a barrier to taking action.

You might decide on a lever arch file with labelled dividers, or a filing cabinet with labelled pockets for your paperwork. For digital documents, set up folders on your computer and back them up externally on a cloud system, such as Google Drive or Dropbox. If you have systems in place already, the start of the year is a great time for an annual tidy-up, making sure you keep paperwork and digital documents going back seven years.

2. Know your net worth

Assets are what you own. This includes the value of your property, and your savings and investments. Liabilities are what you owe. This includes your mortgage, loans and credit cards. The value of your assets minus the value of your liabilities equals your net worth. Knowing your net worth is part of facing up to your financial reality and helps with financial goal-setting. Click here for a document you can download that will help you calculate your assets and liabilities. Keep this updated regularly – ideally every quarter, but at least once a year.

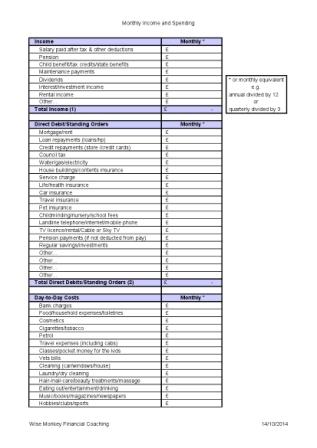

3. Work out your income and spending, then set a budget

Does it come to the end of the month and, yet again, you wonder where all your money has gone? This one is for you. It’s usually pretty easy to work out your weekly or monthly income. In terms of spending, budgeting become easier if you think about 3 different types of spending:

- Fixed spending includes rent/mortgage, bills and food shopping.

- Discretionary spending includes eating out, takeaway coffee, and buying clothes.

- Occasional spending includes the things we know about in advance but can fail to account for until the moment is upon us. Christmas, birthdays and holidays are good examples of occasional spending.

Break down all occasional and discretionary spending into regular monthly chunks and put it aside like you do with money to cover your fixed spending. For instance, if Christmas 2020 is likely to cost you £600, then plan now to save £50 a month – it will be so much easier than trying to find £600 in December. And if you know you spend £2.50 each day on your morning coffee, you’ll need to put aside £75 a month.

January is a good time to do this exercise as it can really help you prioritise your spending, and this is how a budget really helps you take control. You might decide to take your own coffee in a flask for 6 months, for example, and divert the £450 you’ll save towards your summer holiday.

Another good habit is to automate payments to cover your fixed, discretionary and occasional spending. Many of the online banking apps can help you ring-fence money within your current account – for instance as different ‘pots’ or ‘vaults’. Make sure you keep your banking apps updated regularly so you can take advantage of the full functionality of the app.

You could also decide to use different accounts to cover the different types of spending. Fixed spending such as bills might come out of your current account, and you could set up a standing order to a second account to put aside a chunk of money each month for discretionary spending. You’d then spend from the second account when you eat out or buy a new pair of jeans.

As part of this exercise, it’s a good time to look at your fixed expenses. Do you still use your Which? and Netflix subscriptions? Could you move to a cheaper monthly phone contract?

4. Give yourself time to shop around for the best deals

Look at the renewal dates for your car and home insurance, utility providers, fixed-term savings accounts, mobile phone contracts, and lease car agreements. Put a reminder in your physical or digital diary a month before the renewal dates to give you time to shop around. Don’t simply auto-renew. Companies make money by taking advantage of your inertia. By putting a date in your diary in advance of renewal you’re making a conscious decision to shop around and you’re giving yourself the time to do so.

5. Review your app and email subscriptions

Is your inbox full of emails from mailing lists? From Hotel Chocolat to Boden to Easyjet, every brand wants your email address. The New Year is a good time to reduce the number of adverting messages pinging into your inbox and on your social media feeds. Unsubscribe from emails and unfollow them on social media too. You could also delete your card details from websites – the additional barrier of having to input your card details might make you think twice about spending.

6. Talk about money with your partner

If you share your finances with a partner, the New Year is a good time to make a financial plan for the year together. You both need to be clear on how you plan to pay bills, manage joint expenses and what your financial goals are. You could decide to schedule a ‘money meeting’ one weekend, so that you both put time aside to focus on your finances – rather than trying to squeeze it in at the end of a busy day when you’re both tired.

You want to be able to discuss money openly and honestly, and be able to voice your worries and concerns. Work towards creating a consistent dialogue about money so it’s not a contentious issue between the two of you. A good place to start is by agreeing that you want to find a way to navigate conversations about money in a harmonious way.

7. Set yourself some money rules

Rules help you navigate life - guiding your behaviour in a way you’d like, because you’ve rehearsed what you would do should that circumstance arise. If you don’t have rules, it can become a case of anything goes. Or it might leave you making a spending decision on the spur of the moment, or when facing peer pressure. Here are some examples of money rules:

- I don’t spend on the credit card unless it’s critical or can be paid back immediately

- When I overspend in one area, I must underspend in another

- I always ask for money owed immediately

- I prepare all lunches and breakfasts at home

- I keep online purchases in the basket for 24 hours before I buy

- When I feel compelled to shop, I only buy what’s on my ‘things I need’ list that I created especially for moments like this.

Related reading

Ditch New Year's Resolutions - develop good habits instead

Draw your ideal future

Have you committed Financial Infidelity?

5 Habits of successful savers

Sowing the seeds for financial success

Change your money habits one Do at a time

Click here to find out about financial coaching

Click here to find out about Financial Coaching or training to become a Financial Coach

What’s your attitude to money teaching your kids?

If you want your kids to grow up with a healthy attitude to money, the first place to start is to look at your own habits and behaviour with money.

What did you learn about money as a child?

Our beliefs around money - both conscious and unconscious - are mostly informed by what we learn, experience and observe as we grow up. So how you deal with money will undoubtedly influence how your children manage their money as adults.

Money story

I’ve recently been working with a client, Sophie, on her money story and looking at how this feeds into her existing relationship with money. We explored her early experiences with money and began to gain insight into previously unconscious beliefs that had been getting in the way of the results she wants to achieve. Through this work, she slowly began to see how she'd been reinforcing old beliefs through some of the decisions and actions she'd taken.

Scarcity mindset

As a child, Sophie's parents had gone from running a successful family business, with trappings of wealth, to being declared bankrupt. The family had to move out of the house they owned into rented accommodation. She was able to stay at the school she’d always attended but became increasingly aware of her different financial status compared to her peers.

She recalled one time the embarrassment of having to tell her teacher she wasn’t able to afford a school excursion. And another being ridiculed by other pupils for wearing her summer shoes for school in winter months.

Sophie's money story was one of scarcity and now, in adulthood, she found herself giving her children, aged six and nine, conflicting messages about money.

Conflicting money messages

Sophie didn’t want her children to experience the feeling of 'there’s never enough’ that she grew up with so she said yes to everything they wanted. But, at the same time, felt out of control with her spending and had significant anxiety about opening bills or dealing with her finances.

She could see that she was sending conflicting messages, acknowledging that her kids were incredibly perceptive, and that they would see the stress and worry she was experiencing with money.

We discussed a middle ground and what this would look like for Sophie. One that didn't create a sense of entitlement for her kids, while equally not reinforcing her old scarcity message. We then discussed ways of reinforcing this with new behaviours.

As well as getting her into some healthy financial habits, she decided to involve her children in spending decisions and savings plans. We also came up with new language for Sophie to use with her children around money.

The language of 'choice'

Sophie is now involving her children in helping to save up for a campervan for family holidays. It’s an exciting goal that the whole family is looking forward to.

She's able to have the money and choice conversation with her children. When they’re at the shops, for example, instead of saying 'no', she's now expressing financial decisions in terms of goals. For instance, saying something like: ‘I can buy you the magazine you’d like but it means it’ll take us longer to get the campervan for our holidays’.

Rather than giving her kids the sense that there's not enough money, she's helping them see that it's about making conscious spending decisions. Spending less in one area so that they can do something more important. In this way, she's showing her children that money can help create freedom and options.

Teaching them also how to reflect on the decisions they make and regulate their emotions.

Avoid making money a taboo subject

Money is a subject we mostly don’t talk about. So we learn by observation. Not the best way to wire our brains with healthy money habits and beliefs.

Isn't it interesting as a society how we're beginning to break down other social stigmas, yet money is still a taboo subject. Let's talk about money. Don't make the mistake of oversharing with your children about money worries, though, as they may feel a sense of responsibility that doesn’t belong to them.

Sophie became conscious about her use of words like ‘too much’ or ‘too little’. She now tries to strike the right balance , speaking about money in the same way she talks to her kids about food and health. None of us want our kids going into adult relationships being unable to talk about money with their partner or friends.

If we can instill good money management skills in children, then they can carry that forward for the rest of their lives. Being good with money provides so many benefits. It's an important life skill we don't usually get taught. Without it, we can easily fall into the trap of getting into debt and not being able to meet our future goals.

What's your why?

I often see adults who've learned poor lessons from their parents and it might take until their forties or fifties before they start addressing it.

If you have children and need a good hook to help motivate you to stick to good habits, I'd suggest asking yourself: ‘what do I want my children to learn about money as they grow up?’.

Doing it for the sake of your children can be a great ‘why’. If building better money habits for yourself isn't enough of a drive, enabling your children to grow up with a healthy attitude towards money may be the incentive you need.

The benefits of pocket money

Pocket money can be a great idea as it helps your children experience managing their own money and making their own choices. You can help them resist the temptation of small instant gratification purchases in favour of a bigger reward later. Various studies show that delayed gratification is one of the most effective personal traits of successful people.

You could create something similar to interest rates by giving them a bonus. For instance, topping up any savings they make with money of your own. This gives children an understanding of what interest means and the benefits of delayed gratification.

Some piggy banks have different compartments that categorise whether the money is to spend, save, gift, or invest. This shows children how to plan ahead and that money isn’t just for spending.

Involve children in responsible spending decisions

You could also talk your children through some of your decisions. For example, if you are choosing a car park which is further away from your destination but will save you £5, explain that to them.

For older children, when they are at the point of earning money for the first time, it can be helpful to work with them on mapping out their expenses. Include ones they need to plan ahead for, such as birthday presents or holidays. Encourage them to save and join their employer's pension scheme. They're never too young to start financial planning.

Important lessons in life

What life lessons do you want to share with your kids?

Helping them navigate their relationship with money may be one of the most important ones you can teach them.

Related reading

What are we giving our children at Christmas?

5 Habits of successful savers

Sowing the seeds for financial success

What the Elle is Financial Coaching?

Click here to find out about financial coaching

Click here to find out about Financial Coaching or training to become a Financial Coach

Photo by Ashton Bingham on Unsplash

A day in the life of a financial coach

June sunshine is streaming through my new office window as I prepare for events this month where I’ll be sharing the work I’ve created and developed.

I'm excited about the opportunity to inspire client-centred financial advisers about the emotional wow factor of integrating coaching into their practices. I'll be speaking at the Personal Finance Society’s POWER of Financial Planning Conference next week and delivering my own Financial Coach Practitioner Training with my team the week after.

Preparing for both has caused me to step back for a moment to look at my work; to reflect on what I do and why financial coaching is so important. I’ve also recently moved house, which has prompted me to take a fresh look at the life I have created, and the journey that led me to this current place and work.

My transition

I transitioned from a financial advisor to a financial coach when I realised that there was far more to working with people and their money than focusing on maximising assets. How much more meaningful would it be to work the other way round? To focus on life and then see how money could maximise my clients’ fulfilment and enjoyment. And recognising that to do this, I also needed to be able to help clients transform their emotional relationship with money.

Money touches everyone

As one client recently put it:

“The genius of working with money as a medium is that money touches everyone. In money we instil hope, dreams and fears. How we hold shame can be seen by our relation to money as well as that in which we hold pride. Working through the medium of money enables you to access client’s behaviour and emotion, as well as the unconscious workings of belief, value and trust. You can work as deep or as superficially as the relationship allows."

Soul nourishing work

This work nourishes me in a way that financial advising was never able to. Let me describe one day, to give you a sense of what I mean. It was one recent Tuesday that seemed to shine with the joy and satisfaction this work can bring. As well as the usual emails and phone calls, the day included three sets of two-hour sessions with clients.

A day in the life of…

The first session involved helping a woman to see how successfully she had managed to begin the process of gradually easing away from employed life towards setting up her own business, inspired by her passions. Identifying blocks, we gently worked through these, creating a breakthrough in her mind-set. We then moved on to preparing her to negotiate fees in her new role. We rehearsed different strategies and scenarios and identified exercises to support her in believing in her value. This included a practice I taught her to take away that awkwardness that can inhibit negotiating a good deal for yourself, leaving you exuding confidence, even when moments before you hadn’t felt it. She emailed later that week to express gratitude in helping her successfully negotiate a fee that far exceeded what she could have hoped for.

My client in the second session also planned to start a new chapter in her life, first taking a break from the busyness of life to give herself headspace to unwind, reflect and connect back to herself. Working through various life planning exercises, the vision of her future life started to slowly unfold throughout the session, where she saw all the qualities that were profoundly important to her in this new beginning.

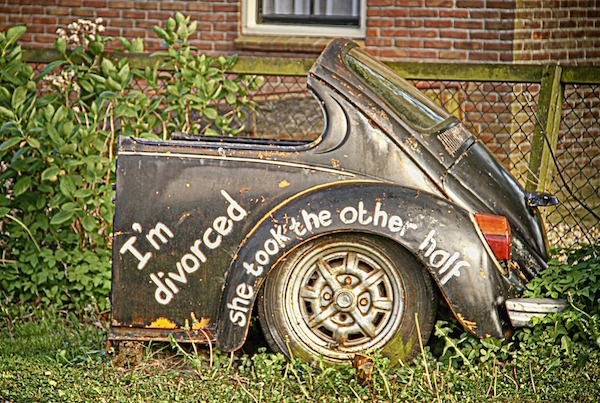

The last session brought a tinge of sadness, mixed with admiration, as I helped a refreshingly united couple work out how best to financially separate after 14 years of marriage. They wanted to do this in the most harmonious way, taking care of each other. They didn’t want to get caught up in legalities, claims and entitlements of normal separation proceedings, and they came to me because they wanted to have a conversation that was witnessed, facilitated, potentially challenged and navigated to ensure they were making the right decisions for the right reasons.

My toolkit

Through these three sessions, I used a wide range of tools in my toolkit – from the fields of coaching, NLP, personal finance and financial life planning. I took my clients through various processes, questions and exercises, which helped them connect to their desired realities and overcome obstacles. On a practical level, I also used Excel and Cashcalc for practical calculations such as modelling different scenarios and estimating mortgage calculations and future spending plans. That’s coaching: empowerment and empathy mixed with financial know-how.

My future vision

This is what I most love about my work. The rich variety of clients I work with and the different ways in which my work can support, guide and inspire, while also helping clients confront and overcome their obstacles.

This is why I take this work, and these tools and concepts, beyond my own business and beyond my own clients. Through my training courses, I am passing on my inspiration, skills and tried and tested methodologies, so this work can potentially reach so many more people. If this approach can be integrated into financial advising, it could bring about a paradigm shift in the way we think and work with finances, helping to change the face of financial services for the future.

In my own practice, I work with clients through Skype or Zoom, by telephone, and with face-to-face sessions in my new garden office. I still pinch myself when I look at my new home and workplace, with uninterrupted views over the South Downs, or when I glance up from my computer to see horses passing by. Perhaps the best part of having created the life and work that is right for me is being able to help others to do the same.

Photo by Simona George Photography

Julia’s training experience

"I was hoping we would be taught approaches and tools to help with coaching, guidance on structuring sessions and the cycle of helping a client. The coaching course has far exceeded my expectations. We were in a small group of six students plus Simonne, Jo a psychotherapist and Anne who has wide experience of coaching. We were given a large resource pack, that is organised clearly, each day is outlined with the tasks and materials for the day and the exercises are timed meticulously.

At the beginning of the course, we individually outlined objectives we hoped to achieve. The course has been structured so half the learning is through practical exercises to embed the knowledge and skills we are being taught, as daunting as this has been at times, it has been the most the challenging and promising part of the course. It has alleviated any fear and anxiety you face as a new coach when you are reframing a client’s negative narrative into a more a positive outlook, whilst asking open non-directive questions to uncover motivation, responding or addressing emotional responses or triggers and then leading the client to their own solutions which are informed by financial knowledge – to effect meaningful behavioural change.

Simonne has a wonderfully warm and engaging manner, sharing her contagious enthusiasm and passion for her work. Clearly so much thought has been given on how best to share her knowledge in a way that is easy to follow - despite our different professional backgrounds, experiences and intuition.

The resources and templates that have been honed during Simonne’s 17 years of coaching are shared to maximise learning and effectiveness in coaching, are made available to us all via dropbox afterwards so we can share them with clients.

I have learnt so many transferable skills and benefitted in my own personal development, I will be taking these reflective work practices to other areas of my private and professional life, such as active listening, reframing, and examining any self-limiting beliefs I might have."

Julia

Photo by Simona George Photography

Draw your ideal future

If you want to create changes in your life, I strongly suggest that you watch this TEDxTalk: Draw your future: Patti Dobrowolski.

The talk is both entertaining and inspiring. It shows you how to leverage your power of imagination and visualisation to actualise the desired vision of your future. I've used this exercise personally, and with many clients, with remarkable results.

In fact, I did this exercise for myself many years ago and it's all coming true, without me even realising it. I found my drawing again on the day I moved home and saw that amongst the pictures on the 'desired new reality' were 2 detached houses side by side - one small and one bigger. Then realised that this is what we were moving to. At the time, I recall it representing a separate space to work away from home, but now see that this is my little office in the garden of my new home. Spooky eh?!

One thing worth mentioning though is that when clients I've worked with watch it and draw their own, I spot that they've used Patti's words for their 3 bold steps (SEE IT; BELIEVE IT; ACT ON IT). But these words aren't shared for you to use, simply as an example. And I would suggest words that are articulated with more specific actions in mind, for example something like 'LET GO' (which to you, for instance, could mean only saying 'yes' to opportunites alligned to the results you want).

Part of the power of the process is to see what words intuitively spring to mind. These should be your steps, in your own langauge, to get to your desired reality.

The act of focusing on what is truly and profoundly important to you, and identifying your bold steps, has a powerful impact. Clearly, you have to take action too. But change always starts with clear, sharp, focus on what you want.

Click here to download her template.

Related reading

Spring clean your finances

Don’t let your Chimp take charge of your money

Digital banks helping people manage money mindfully

Ditch New Year's Resolutions - develop good habits instead

Have you committed Financial Infidelity?

5 Habits of successful savers

Sowing the seeds for financial success

Click here to find out about Financial Coaching or training to become a Financial Coach

Ditch New Year’s Resolutions – develop good habits instead

Lose weight! Get fit! Start saving!

It’s that time of year again – the time of New Year resolutions and goal-setting. This year, though, let’s do something different and focus on habits instead.

Think of a goal as a result you want to achieve. And habits – the things you do regularly without even thinking about it - as the process that will get you there. Of course, goals are crucial in helping you determine the direction you want to do, but it’s far more important to spend time designing the right process.

My work as a financial coach is often focused on working with people who want to change their financial results, sometimes having buried their head in the sand with their finances for several years. This usually involves helping them change their behaviour with money and form new, positive habits that requires small and consistent action – small, because it’s more achievable; and consistent, because this helps habits ‘stick’.

Habits change behaviour

But before you can form good habits, you need to recognise your triggers for the habits you want to change that are holding you back and rehearse different ways to resolve them.

I worked on this with one of my clients. Terri was in her thirties and a high earner but with nothing to show for it. She had been in debt all of her adult life. When she came to see me, her goal was to be debt-free and get on the property ladder. She knew her spending habits weren’t serving her as despite earning more, she was still accumulating more debt.

We focused on working through her spending triggers and forming new habits that served her. For example, one of her spending triggers was to do with her commute home from work.