Why every woman deserves a freedom fund

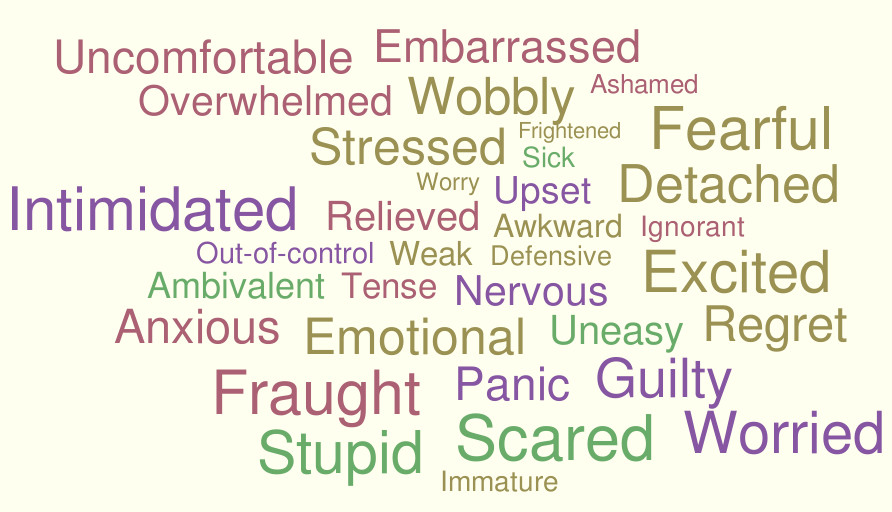

A freedom fund isn’t just a rainy-day pot - it’s about creating choices. In this article, we explore why having your own savings set aside matters, especially for women. Sharing practical ways to start building a freedom fund, how it differs from an emergency fund, and the mindset shifts that make saving possible even in tough times. With real-life insights from my coaching work, you can see how small steps can grow into the confidence and independence to shape your own path.